boulder co sales tax rate 2020

Boulder Countys Sales Tax Rate is 0985 for 2020 Sales tax is due on all retail transactions in addition to any applicable city and state taxes. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city.

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County

A county-wide sales tax rate of 0985 is applicable to localities in Boulder County in addition to the 29 Colorado sales tax.

. For tax rates in other cities see. The current total local sales tax rate in Boulder UT is 8100. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and.

Determining the increase in base revenue can be. The December 2020 total local sales tax rate was 8845. This document lists the sales and use tax rates for all Colorado cities counties and special districts.

The 81 sales tax rate in Boulder consists of 48499 Utah state sales tax 125 Garfield County sales tax 1 Boulder tax and 1 Special. This is the total of state and county sales tax rates. The December 2020 total local sales tax rate was 8250.

The current total local sales tax rate in Boulder CO is 4985. The December 2020 total local sales tax rate was also 8100. With local taxes the total sales tax rate is between 2900 and 11200.

The ESD tax is on. The minimum combined 2022 sales tax rate for Boulder Colorado is. It also contains contact information for all self.

2055 lower than the maximum sales tax in CO. Higher sales tax than 97 of Utah localities. Boulder County CO Sales Tax Rate.

Colorado has recent rate changes Fri Jan 01 2021. This is the total of state county and city sales tax rates. Some cities and local.

About City of Boulders Sales and Use Tax. Boulder City NV Sales Tax Rate. The Boulder Sales Tax is collected by the merchant on all qualifying sales.

The Boulder County Sales Tax is 0985. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11. The Colorado state sales tax rate is currently.

As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. The Boulder County Niwot Lid Colorado sales tax is 599 consisting of 290 Colorado state sales tax and 309 Boulder County Niwot Lid local sales taxesThe local sales tax consists of. What is the sales tax rate in Boulder Colorado.

2055 lower than the maximum sales tax in CO. The current total local sales tax rate in Boulder City NV is 8375. The December 2020 total local sales tax rate was also 4985.

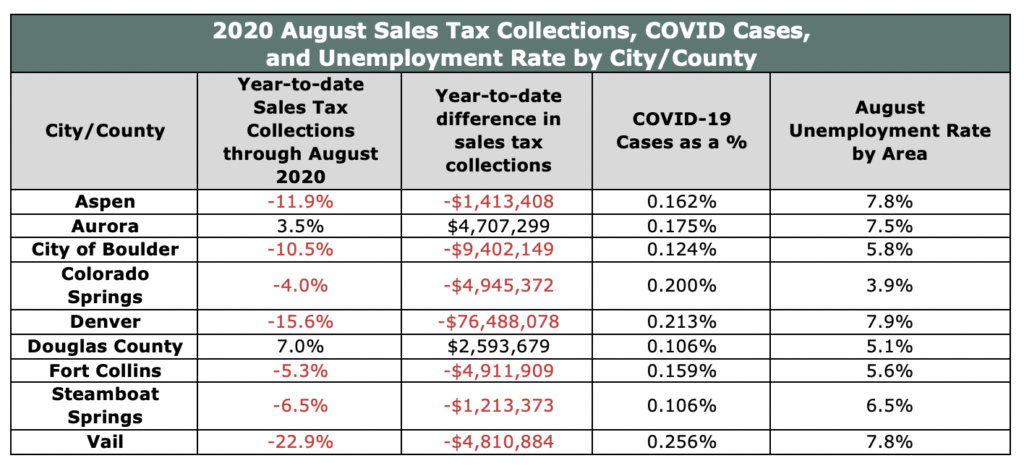

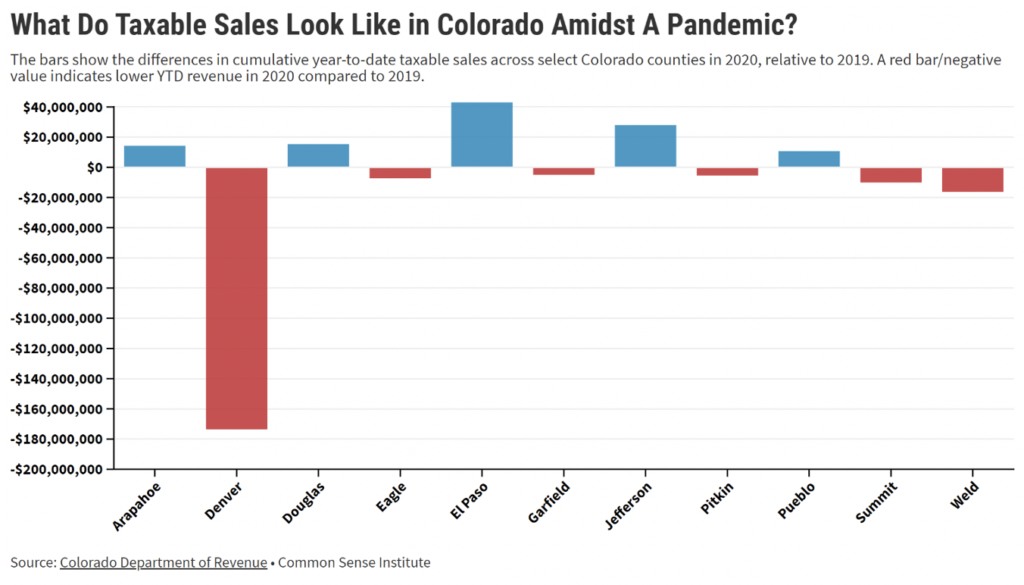

The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs. The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020. Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR.

Boulder CO Sales Tax Rate. The December 2020 total local sales tax rate was 8845. Current City of Boulder use tax rate is 386.

Our tax lien sale was held November 5 2021. The 2020 Boulder County sales and use tax rate is 0985. The Boulder County Sales Tax is.

The Boulder County Remainder Colorado sales tax is 499 consisting of 290 Colorado state sales tax. The minimum combined 2022 sales tax rate for Boulder County Colorado is. 499 Is this data incorrect Download all Colorado sales tax rates by zip code.

The state sales tax rate in Colorado is 2900. Effective July 1 2022. July to December 2020.

The current total local sales tax rate in Boulder County CO is 4985. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle.

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

California Sales Tax Rates By City County 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Taxpayer Information Henderson Nv

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

2021 Property Appraisals And Tax Rates For Resorts At Walt Disney World

Nevada Property Tax Calculator Smartasset

Vape E Cig Tax By State For 2022 Current Rates In Your State

Sales And Use Tax City Of Boulder

Armco Rebrands As Aces Quality Management Send2press Newswire Risk Management Financial Institutions Consumer Lending

File Sales Tax Online Department Of Revenue Taxation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute